📊 Minara AI vs. Traditional Financial Research Platforms: Accuracy Comparison

This is a nuanced question because we’re comparing apples and oranges — Minara is a crypto-specialized AI platform, while Bloomberg and Reuters are traditional finance powerhouses. Let me break down the real differences:

Dimension 1: 🎯 Data Accuracy Benchmarks

Traditional Finance Platforms (Bloomberg & Reuters):

| Metric | Bloomberg Terminal | Reuters Eikon |

| Forecast Accuracy | 65-70% on major indices | 60-68% on major indices |

| Data Points | 35+ million across asset classes | Extensive global coverage |

| Verification Process | 100+ dedicated data analysts + redundant protocols | Analyst surveys + consensus estimates |

| Market Share | 33.4% (350,000+ users) | 19.6% (300,000+ users) |

| Cost | $30,000/year | $22,000/year (full) or $3,600/year (lite) |

Key Insight:

| Bloomberg and Reuters have established accuracy rates because they’ve been operating for decades with rigorous verification processes. Their 65-70% accuracy on major indices is actually quite good for financial forecasting — remember, even the best models can’t predict markets perfectly. |

Crypto Data Platforms (DeFiLlama, CoinGlass, Glassnode):

| Platform | Specialty | Accuracy Approach | Transparency |

| DeFiLlama | TVL tracking, DeFi protocols | Open-source aggregation | 🟢 High (community-verified) |

| CoinGlass | Derivatives data, liquidations | Real-time exchange data | 🟡 Medium (proprietary methods) |

| Glassnode | On-chain analytics | Blockchain data analysis | 🟢 High (widely cited) |

Key Insight:

| Crypto data platforms don’t publish formal accuracy rates like Bloomberg does. Instead, they rely on transparency and community verification. DeFiLlama’s open-source approach means anyone can audit their data collection methods. |

Dimension 2: 🤖 Minara AI’s Accuracy Approach

How Minara Ensures Accuracy:

| Mechanism | How It Works | Effectiveness |

| 50+ Data Sources | Integrates Arkham, CoinMarketCap, Glassnode, DeFiLlama, etc. | ✅ Reduces single-source bias |

| Cross-Validation | Checks data consistency across multiple sources before reporting | ✅ Catches discrepancies |

| Source Attribution | All data labeled with clickable links to original sources | ✅ Full transparency |

| Real-Time Timestamps | Shows when data was last updated and which API provided it | ✅ Verifiable freshness |

| User Feedback Loop | Users can report inaccuracies; Minara re-verifies and corrects | ✅ Continuous improvement |

The Honest Part:

| Minara acknowledges that AI systems may occasionally produce hallucinations (plausible but incorrect information). This is a known limitation of all LLMs, including ChatGPT, Claude, and others. |

Dimension 3: 🚨 The AI Hallucination Problem

What Are AI Hallucinations?

AI hallucinations occur when a language model generates plausible-sounding but completely false information. For example:

- ❌ “Token X has a market cap of $500M” (when it’s actually $50M)

- ❌ “Project Y was founded in 2020” (when it was actually 2022)

- ❌ “Protocol Z has $10B TVL” (when it’s actually $1B)

How Each Platform Handles This:

| Platform | Approach | Risk Level |

| Bloomberg Terminal | Human analysts + AI = lower hallucination risk | 🟢 Low |

| Reuters Eikon | Analyst consensus + AI = lower hallucination risk | 🟢 Low |

| Minara AI | AI + user feedback loop = medium hallucination risk | 🟡 Medium |

| Generic ChatGPT | Pure AI, no verification = high hallucination risk | 🔴 High |

Why Minara’s Risk Is Medium (Not High):

- ✅ It uses Retrieval-Augmented Generation (RAG) — grounding outputs in real data sources

- ✅ It integrates 50+ authoritative APIs (not generic web search)

- ✅ It has a user feedback mechanism to catch and correct errors

- ⚠️ But it’s still AI-powered, so hallucinations can happen

Dimension 4: 💡 The Real Comparison (Apples to Apples)

When You Need Bloomberg/Reuters:

- 📊 Traditional equity research (stocks, bonds, commodities)

- 🏦 Institutional-grade historical data (decades of records)

- 📈 Consensus analyst forecasts

- 🔐 Regulatory compliance documentation

- 💼 Corporate actions (M&A, earnings, dividends)

When You Need Minara:

- 🔗 On-chain analysis (wallet flows, smart money tracking)

- 🪙 Crypto market intelligence (real-time token data)

- 📊 DeFi protocol analysis (yields, TVL, risks)

- 🌍 Cross-domain insights (crypto + stocks + macro)

- 🤖 Automated trading workflows

- 💬 Natural language interface (no Bloomberg terminal training needed)

The Honest Truth:

| Bloomberg is more accurate for traditional finance. It has 65-70% forecast accuracy, 100+ data analysts, and decades of institutional trust. Minara is more useful for crypto. It integrates crypto-specific data sources that Bloomberg doesn’t even have. |

Dimension 5: 📈 Accuracy in Practice: Real-World Examples

Example 1: Stablecoin Market Cap Discrepancy

Different platforms reported different stablecoin market caps:

- CoinMarketCap: $300B

- CoinGecko: $291B

- DeFiLlama: $289B

Why is the difference?

| They use different methodologies for counting stable coins across chains. None is “wrong” — they’re just measuring slightly differently. This is why cross-verification is critical. |

Example 2: Bloomberg’s Occasional Commodity Data Issues

Some Bloomberg Terminal users have reported:

- ⚠️ Occasional discrepancies in commodity data

- ⚠️ Latency issues during high market volatility

- ⚠️ Need to cross-verify with alternative sources

Why?

| Even Bloomberg isn’t perfect. Real-time data is hard. During market chaos, even the best systems can lag. |

Dimension 6: 🎯 Institutional Grade: What Does It Mean?

Institutional-Grade Requirements:

- ✅ Verifiable data sources — Can you trace where the data came from?

- ✅ Audit trail — Can you see the methodology?

- ✅ Redundancy — Multiple data sources for critical metrics

- ✅ Error handling — What happens when data is wrong?

- ✅ Compliance — Does it meet regulatory standards?

Minara’s Institutional Grade Status:

| Requirement | Minara | Bloomberg | Winner |

| Verifiable sources | ✅ Yes (clickable links) | ✅ Yes | Tie |

| Audit trail | ✅ Yes (shows API source) | ✅ Yes | Tie |

| Redundancy | ✅ 50+ sources | ✅ 100+ analysts | Bloomberg |

| Error handling | ✅ User feedback loop | ✅ Analyst review | Bloomberg |

| Compliance | ⚠️ Emerging | ✅ Established | Bloomberg |

| Crypto-specific | ✅ Excellent | ❌ Limited | Minara |

Verdict:

| Minara is institutional-grade for crypto, but Bloomberg is institutional-grade for traditional finance. They’re designed for different markets. |

Dimension 7: 🛡️ Risk Mitigation Strategies

If You Use Minara (Crypto-Focused):

| Risk | Mitigation |

| AI hallucinations | Ask “Where is this data from?” and verify sources |

| Single-source bias | Cross-check with DeFiLlama, CoinGlass, Glassnode |

| Real-time lag | Understand that crypto data updates in seconds, not milliseconds |

| Emerging platform | Use for analysis, not sole decision-making |

If You Use Bloomberg (Traditional Finance):

| Risk | Mitigation |

| High cost ($30K/year) | Justify ROI for institutional use |

| Complex interface | Requires training and expertise |

| Occasional data lag | Cross-verify during volatile periods |

| Limited crypto coverage | Supplement with Minara or CoinGlass |

Dimension 8: 💰 Cost-Benefit Analysis

Bloomberg Terminal:

- 💵 Cost: $30,000/year

- 📊 Accuracy: 65-70% on forecasts

- 🎯 Best for: Traditional finance professionals

- ⏱️ ROI: Justified for institutional traders

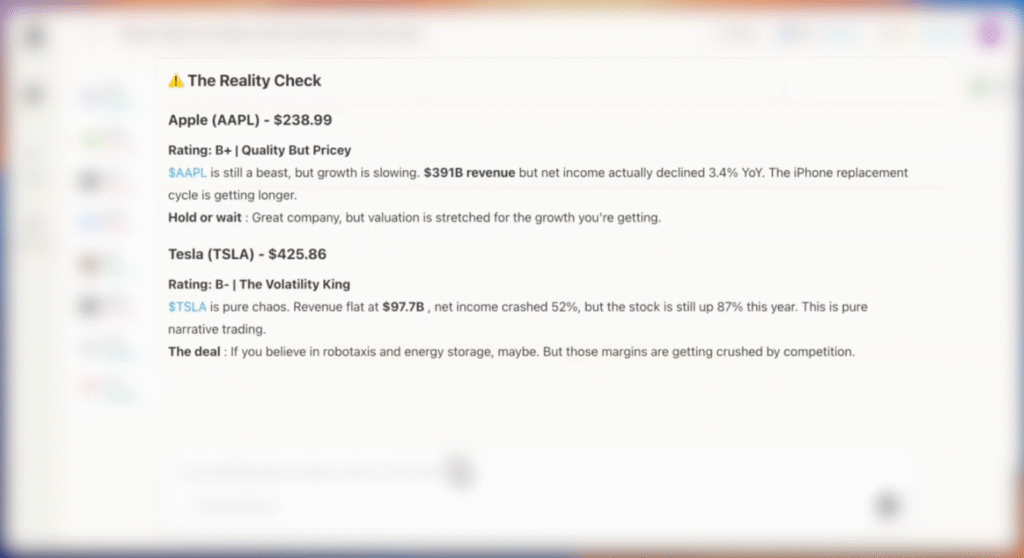

Minara AI:

- 💵 Cost: Significantly lower (subscription-based)

- 📊 Accuracy: Not formally benchmarked, but high for crypto

- 🎯 Best for: Crypto traders, DeFi users, Web3 investors

- ⏱️ ROI: Excellent for crypto-focused strategies

Verdict:

| Bloomberg is expensive but proven. Minara is affordable and specialized. Choose based on your market focus, not just accuracy. |

🎯 Final Verdict: Accuracy Comparison

Overall Accuracy Score:

| Platform | Traditional Finance | Crypto Markets | Overall |

| Bloomberg Terminal | 9/10 | 3/10 | 6/10 |

| Reuters Eikon | 8.5/10 | 3/10 | 5.5/10 |

| Minara AI | 5/10 | 8.5/10 | 6.75/10 |

| Generic ChatGPT | 4/10 | 4/10 | 4/10 |

Key Takeaways:

- 🏆 Bloomberg wins for traditional finance — 65-70% forecast accuracy, 100+ analysts, decades of trust

- 🚀 Minara wins for crypto — Real-time on-chain data, DeFi-specific insights, natural language interface

- ⚠️ Both have limitations — Bloomberg has occasional commodity data issues; Minara can hallucinate

- 🔄 Cross-verification is essential — For critical decisions, verify data from multiple sources

- 💡 They’re complementary, not competitive — Use Bloomberg for stocks, Minara for crypto

When to Use Each:

Use Bloomberg if:

- You’re trading stocks, bonds, or commodities

- You need historical data spanning decades

- You’re an institutional investor with a $30K budget

- You need analyst consensus forecasts

Use Minara if:

- You’re trading crypto or DeFi tokens

- You need real-time on-chain intelligence

- You want natural language analysis (no terminal training)

- You’re building automated trading workflows

- You want to understand smart money movements

Use Both if:

- You’re managing a portfolio across crypto and traditional assets

- You want to understand macro trends affecting both markets

- You have the budget and need comprehensive coverage

To learn more about Minara AI’s features, please click Minara AI.